Your payment infrastructure may quietly put your business at risk. While retail technology leaders focus on digital transformation initiatives, many overlook a growing challenge: their payment systems are quickly nearing a compliance cliff. With PCI PTS POI 7.0 set to release in 2025 and PCI 5.x approaching end-of-life, the window for strategic modernization is closing.

The Hidden Costs of Legacy Payment Systems

Technical leadership in retail must confront systemic challenges that directly impact the bottom line. Outdated payment systems typically function on closed architectures, making it costly and complex to integrate modern cloud services and APIs. These legacy systems create security vulnerabilities and compliance risks while significantly limiting processing capacity during peak periods.

The operational impact goes beyond technical limitations. Retailers manage multiple disconnected systems, each requiring a maintenance schedule and support resources. Training staff becomes increasingly burdensome as new employees navigate complex, outdated interfaces. The absence of real-time data integration hampers inventory management and obstructs the collection of valuable customer insights.

These challenges lead to poor customer experiences and heightened security risks. Legacy systems frequently struggle to meet PCI DSS 6.0 requirements, particularly concerning enhanced software security and authentication controls. This compliance gap, along with delays in transaction processing and limited payment support, presents significant business risks.

Strategic Advantages of Modern Payment Infrastructure

Forward-thinking retail organizations are leveraging Android-based payment solutions to create competitive advantages. The technical benefits begin with an open architecture that enables seamless integration with existing retail management systems. All Newland NPT devices exceed PCI-PTS 6.x requirements, incorporating secure boot mechanisms, point-to-point encryption (P2PE), and tamper-responsive security modules.

These technical advantages translate into operational improvements. A unified platform reduces maintenance overhead and simplifies staff training. Mobile payment capabilities enable flexible store layouts, while real-time transaction data feeds into advanced analytics and inventory optimization systems.

Newland NPT's Enterprise-Grade Solutions

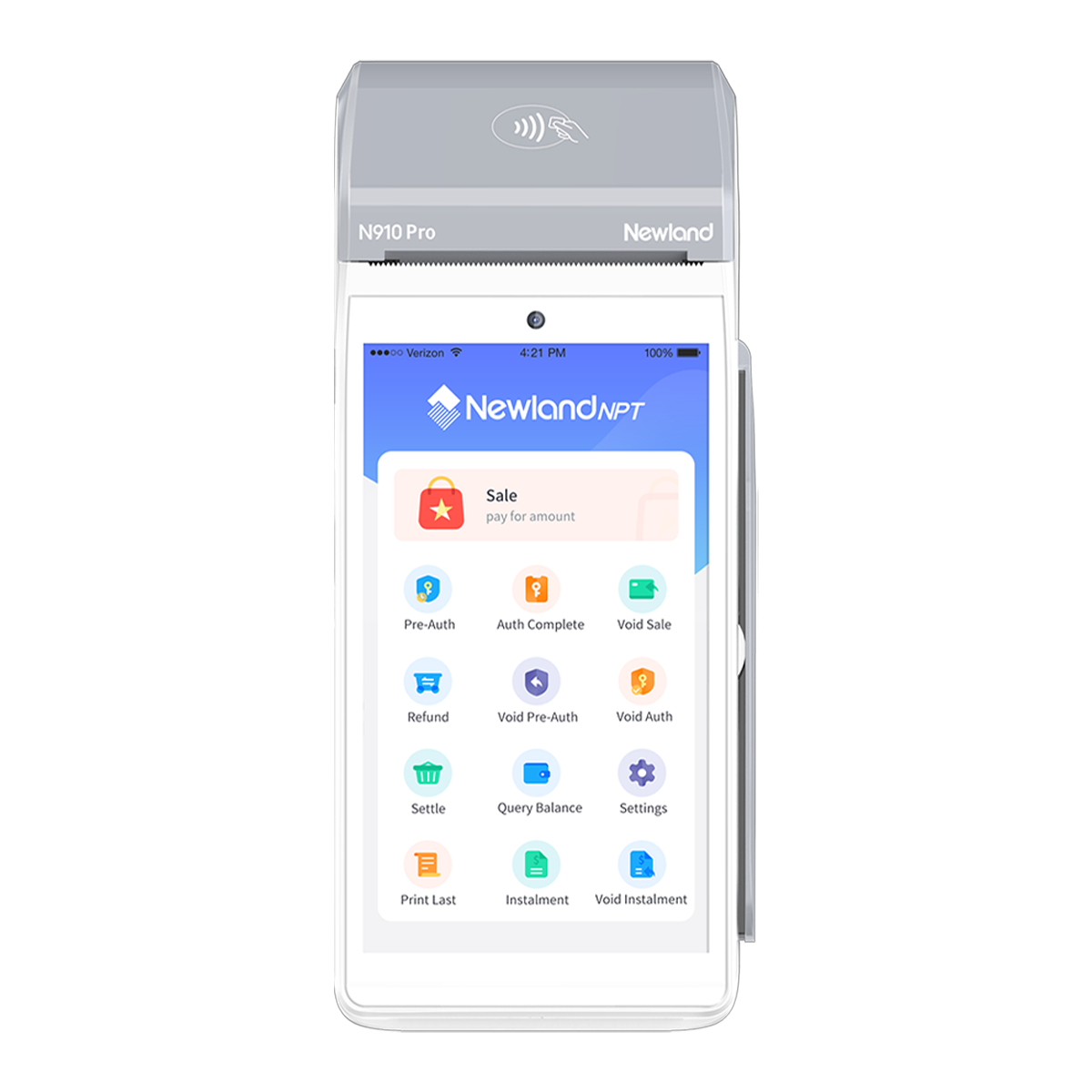

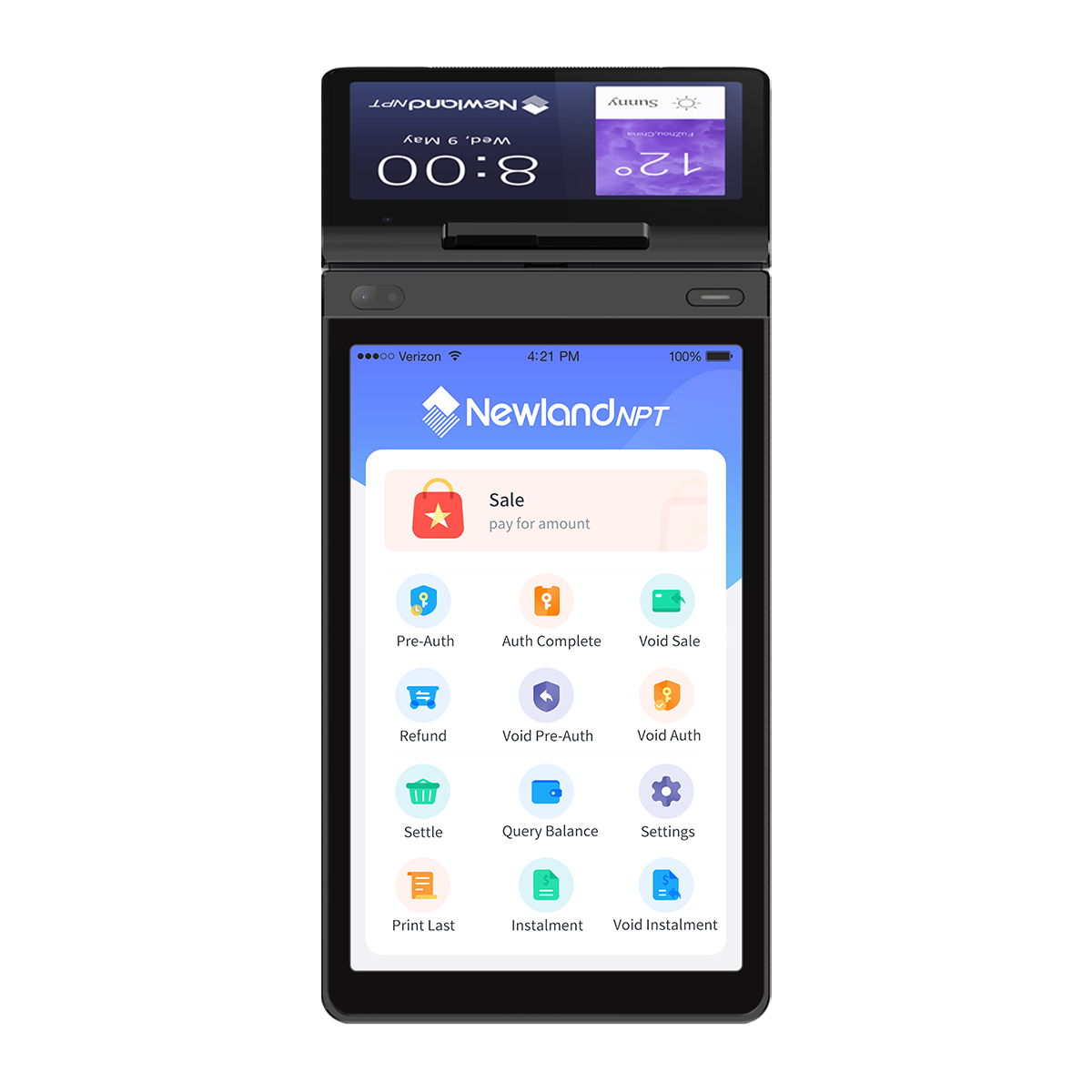

As a global leader in payment technology with over thirty years of experience, Newland NPT provides a complete range of Android-based payment solutions tailored for enterprise retail environments.

The N950 SmartPOS Series is our flagship mobile payment solution, providing enterprise-grade processing with seamless POS integration. Offered in several form factors (N950, N950K, N950S), each device includes a dedicated security processor, encrypted key storage, and physical security measures that surpass PCI-PTS 6.x requirements.

Our X800 Smart ECR offers a complete payment and management solution that integrates advanced membership features with inventory management capabilities. The P300 Multilane SmartPOS provides exceptional processing power and extensive API support for custom integration in high-volume settings.

Implementation and ROI

Understanding the complexities of deploying enterprise technology, we designed our solutions for practical implementation and measurable returns. The familiar Android interface significantly eases staff training, while our open architecture facilitates phased migration from legacy systems. Comprehensive API documentation and round-the-clock enterprise support ensure operational continuity throughout the transition.

Experience the Future of Retail Payment Technology

Explore these innovations at NRF 2025, January 12-14 in New York. Visit Booth 938, Level 1, where our technical team will demonstrate how our solutions can transform your retail operations while protecting existing technology investments. Our consultants will be available to discuss integration strategies, security requirements, and deployment planning.